Both established automakers and newcomers are releasing new electric vehicles to satisfy rising consumer demand.

Increasingly high prices and stringent new federal rules are putting a strain on a labour-intensive and financially burdensome procedure.

The financial health of some of the most well-known American electric vehicle startups of the past few years is discussed on our website.

As the market shifts from gas to electric automobiles, manufacturers are increasingly motivated by profit.

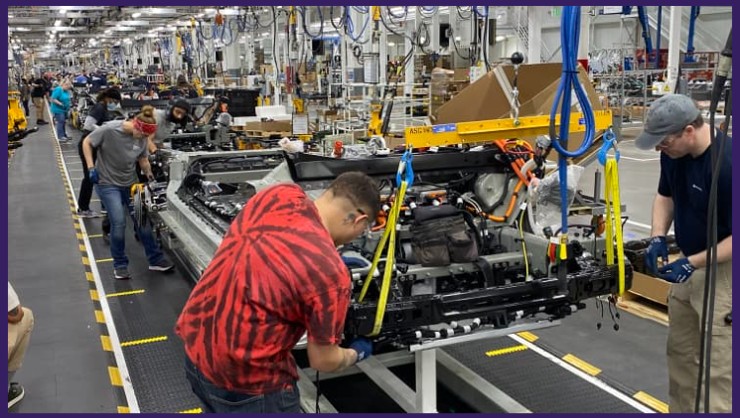

Both well-established carmakers and up-and-coming manufacturers are releasing new battery-powered vehicles to satisfy rising consumer demand. Increasing material costs and complex requirements for federal incentives are adding stress and expense to the already difficult process of ramping up production of a new model.

EV Price Increases

Lithium, nickel, and cobalt, three of the raw elements used in many electric-vehicle batteries, have seen their prices surge over the last two years as demand has skyrocketed. It may be several years before miners are able to significantly expand supply.

To further complicate matters, in order for manufacturers to continue to receive incentives for selling electric vehicles in the United States, more and more of those materials will need to be sourced in North America.

The end result is added financial strain on an already pricey procedure.

The development and implementation of tooling for the production of new high-volume automobiles can cost automakers hundreds of millions of dollars before the first vehicle is even sold. Almost every automaker in the world today has a $20 billion cash hoard or more. When sales and revenues take a hit due to a recession (or a pandemic), corporations have those reserves to fall back on so they can keep working on their next new models.

It’s possible the manufacturer won’t recoup its investment in time and resources if the market rejects the new model, or if production issues delay its release or lower its quality.

Financial risks associated with developing a new electric vehicle can be catastrophic for up-and-coming automakers.

Effects in Tesla

Imagine a Tesla. To get ready for the debut of the Model 3, Tesla CEO Elon Musk and his team reportedly spent over a billion dollars on robots and sophisticated machinery. As a result of problems with the automation, Tesla had to relocate a portion of the factory’s final assembly to a temporary tent located in the parking lot.

Tesla had to learn many difficult things the hard way. Musk later asserted that the launch of the Model 3 was “production hell” and nearly bankrupted Tesla.

More and more financiers are learning the hard way that it takes a lot of money to get a vehicle from the drawing board into production as younger EV firms increase output. In addition, Wall Street is paying special attention to the cash reserves of EV companies because it is now more difficult to raise capital than it was a year or two ago, due to falling stock prices and rising borrowing rates.

Here is a look at the current financial status of several high-profile American EV companies from the past few years:

Rivian Car

With almost $15 billion in the bank as of the end of June, Rivian is in the best possible position among the new EV firms. CFO Claire McDonough stated during an August 11 earnings call that this amount should be sufficient to sustain the company’s operations and expansion through the debut of its smaller “R2” vehicle platform in 2025.

Due to supply chain delays and teething problems at the factory, Rivian has had trouble ramping up production of its R1-series pickup and SUV. While the business burned through around $1.5 billion in the second quarter, it has stated that it will lower its near-term capital expenditures to about $2 billion this year, down from $2.5 billion in its earlier estimate.

One analyst predicts that Rivian will need a capital increase well before 2025: Morgan Stanley analyst Adam Jonas stated in a note released after Rivian’s earnings announcement that his firm’s model anticipates Rivian would raise $3 billion via a secondary stock offering by the end of next year and another $3 billion via further fundraising in 2024 and 2025.

Jonas now recommends “overweight” and a $60 price target on shares of Rivian. On Friday, shares of Rivian closed at around $32.

Lucid Car

Lucid Group, another premium electric vehicle manufacturer, is not in as strong a position financially as Rivian. They had $4.6 billion in cash at the end of the second quarter, down from $5.4 billion at the end of March. That will persist “far beyond 2023,” CFO Sherry House said earlier this month.

Similar to Rivian, Lucid has had trouble increasing production since the launch of their Air luxury vehicle last fall. It plans to invest heavily in the growth of its Arizona plant and in the construction of a new facility in Saudi Arabia. The sovereign wealth fund of Saudi Arabia owns around 61% of the California-based EV manufacturer Lucid and would almost likely step in to aid if the company ran short of cash, unlike Rivian which has no such patron.

Wall Street analysts were generally unfazed about Lucid’s cash burn during the second quarter. John Murphy of Bank of America said that with Lucid’s “recently obtained revolver [$1 billion credit line]” and “incremental investment from various organizations in Saudi Arabia earlier this year,” the business has a “runway into 2023.”

Murphy recommends investors “buy” shares of Lucid and sets a price target of $30 per share for the company’s stock. He has drawn parallels between the startup’s prospective profitability and that of Ferrari, the high-end sports car manufacturer. Prices for Lucid shares have been around $16 recently.

Fisker Car

Fisker, unlike Rivian and Lucid, has no plans to develop a plant specifically for the assembly of its electric vehicles. Auto production will instead be outsourced to Magna International, a major supplier to the automotive industry, and Foxconn, a contract manufacturer based in Taiwan.

That’s something of a cash tradeoff; Fisker won’t have to shell out as much initially to get production rolling on its forthcoming Ocean SUV, but it will almost surely eat into profit to compensate the manufacturers.

The Magna-owned facility in Austria will begin producing Oceans in the month of November. With $852 million on hand as of the end of June, Fisker should have no issue financing its substantial spending in the meantime, including money for prototypes and final engineering as well as payments to Magna.

Even with its contract-manufacturing approach, RBC analyst Joseph Spak said after Fisker’s second-quarter report that the company will likely need additional capital — perhaps $1.25 billion over “the coming years.”

For Fisker shares, Spark has set a price target of $13 and a “outperform” rating. On Friday, shares cost $9, which was the trading day’s closing price.

Nikola Car

Nikola was an early electric vehicle manufacturer to go public via a combination with a SPAC. The Tre battery-electric semi truck has started selling in limited quantities, and the business intends to increase manufacturing and introduce a long-range hydrogen fuel-cell variant of the Tre in 2023.

Although at the moment it probably doesn’t have the funds to get there. After allegations from a short-seller, a precipitous drop in the stock price, and the resignation of the business’s vocal founder Trevor Milton, who is now facing federal fraud charges for statements made to investors, the company has had a harder time acquiring capital.

The end of June saw Nikola with $529 million in the bank and an additional $312 million accessible through an equity line from Tumim Stone Capital. During an earnings call for the company’s second quarter, CFO Kim Brady stated that this amount was sufficient to sustain operations for another 12 months, but that further funding will be required soon.

Given our goal of maintaining 12 months of liquidity at the end of each quarter, we will continue to explore the right opportunities to replenish our liquidity on a continuous basis while seeking to limit dilution to our shareholders, Brady added. We are giving serious thought to ways we may reduce spending in 2023 without cutting back on essential initiatives.

According to Emmanuel Rosner, an analyst at Deutsche Bank, Nikola would need to fund $550 million to $650 million by the end of the year, and possibly more. Hold, with an $8 price target, is his opinion on Nikola stock. As of Friday’s trading, a share in the company costs $6.

Lordstown Car

Lordstown Motors’ $236 million in cash on hand as of the end of June puts it in the most vulnerable situation of the bunch.

Lordstown, like Nikola, saw its stock price plummet after the company’s founder was ousted due to short-seller charges of fraud. By May, the business had finalized an agreement with Foxconn to sell its Ohio factory, a former General Motors plant, for around $258 million as part of its transition from a factory model to a contract-manufacturing arrangement like Fisker’s.

Foxconn intends to use the plant to produce electric vehicles (EVs) for other firms, such as the planned compact Fisker EV named the Pear and the Lordstown Endurance truck.

Rosner, an analyst at Deutsche Bank, maintains a “hold” rating on Lordstown stock despite the company’s daunting prospects. Nonetheless, his outlook is not optimistic. After deciding to cap initial Endurance manufacturing at 500 units, he believes the firm will still need to raise $50 million to $75 million to sustain operations through the end of the year.

To finish production of this initial batch, management will need to raise more substantial financing in 2023, Rosner wrote after Lordstown’s second-quarter financial report. Not an easy task, considering the company’s history of struggles.

He stated, “In order to obtain finance, Lordstown would need to show significant traction and positive reaction for the Endurance among its initial consumers.”

Rosner has a $2 price objective on shares of Lordstown stock and a “hold” recommendation. On Friday, shares had a final price of $2.06.